How to Trade with Divergence

Personally, I feel the movie wasn't doing such a great job following what's written in the Novel. I think the writing on this particular instalment could be a lot better. According to IMDB, the rating was only 6.6/10, I couldn't agree more.

Personally, I feel the movie wasn't doing such a great job following what's written in the Novel. I think the writing on this particular instalment could be a lot better. According to IMDB, the rating was only 6.6/10, I couldn't agree more.

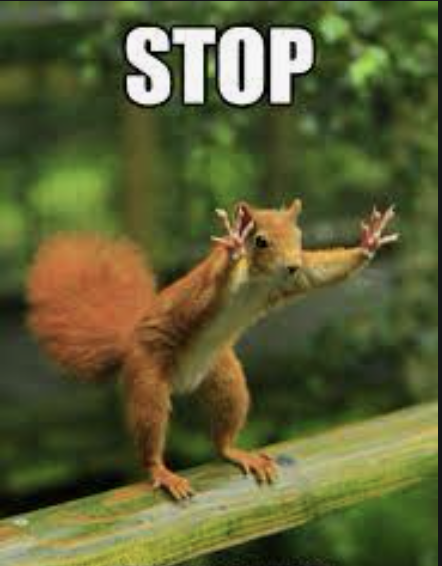

Hold on, wait.

You said Divergence, not the movie Divergent.

Sorry about that, got a little carried away... Let's diverge from that, (no pun intended).

I have previously written a very extensive blog regarding types of Divergence you'll see in the markets. I suggest having a read at it first before continuing with this article.

In this article however, I'm going to keep things a little simple, giving you a step-by-step technique to approach the markets using Divergence.

Here are the topics I'll be going over:

1. What Is Divergence?

2. Pros And Cons Of Using Divergence

3. How To Draw Divergence

4. Entry Techniques For Divergence

5. Conclusion

1. What Is Divergence?

Now, one thing is for sure, we know I'm not talking about the movie/novel. But on the charts, Divergence is a phenomenon where the price and the indicator are not moving in the same direction, and yes you said it, they diverge from one another.

Let's look at this:

Here, as price moves higher, look at the highs of the indicator, it follows price, making higher highs as well. In this case, there is no Divergence going on.

But here:

See how price is constantly moving up making new highs, but on this last swing, the indicator actually makes a lower high.

That's a Divergence.

When we have Divergence, it could be an indication that the trend is dying out and we may start to see a turn around. I go more in depth regarding the 'Whys' behind this here.

And it's very typical that you'll see traders starting to take their position here anticipating the trend to turn.

STOP if you are going to try this out right now, because doing just what I described above is a little dangerous. There's a little more that goes into this.

Let me explain.

2. Pros And Cons

Pros

The main reason why this is can be a very powerful strategy is because traders who trade this are not typically chasing the highs or lows. Instead, there is a sense of anticipation involved.

They are anticipating the end of a trend.

That's good because the logic of 'buying low, selling high' is exactly what's going on here.

If you were to trade this Divergence setup:

I'm sure you'll be talking about this to your trading peers for almost a solid week, saying that you've found the Holy Grail of trading.

Cons

The flip side to this is, sometimes it's subjective.

Take a look:

Which Divergence would it be then? If you had taken all the trades here every time a divergence showed up, you would have lost a lot of money.

So much for Holy Grail huh....

It gets a little subjective sometimes, because you won't be sure when to actually trust the Divergence.

Before you give up, let me show you how we usually look for higher probability ones.

3. How To Draw Divergence

Let's take a small step back, to give you a more structured way of looking at where to draw your divergence, you want to focus on the swings of the move on the charts for both the price and the indicator.

Here:

Notice how the highs of the swings are connected on the price, whilst we connect the swing highs of the Indicator. When you see that they are not going in the same direction, you'll have divergence.

Here's an example for a down trend.

Pretty simple right?

Again for more examples, have a look at the previous blog I've written here.

4. Entry Technique

Treat this like an Extra Confirmation you need for your Divergence to have a higher degree of probability to work out.

Step 1:

We want to make sure the trend is slowing down before looking at the Divergence forming. You guys who are in the Mastering Price Action 2.0 Program would use the Digestion/Rubber Band Man technique here.

Have a look:

Alongside Divergence, you can see that the uptrend is slowing down. Ie, each push it makes, has a deeper pullback. It's not a typical strong and powerful uptrend. Just visually, it seems like it could turn.

Step 2:

To make sure we are clear for the 'turn', we want to see the last swing being taken out. Sort of like taking out the Last Guy Who Started (this is explained in the Mastering Price Action 2.0 Program )

In this case, that last swing would be here:

These are the criteria you want to have before taking the trade.

In a way, it's like making sure the price on the chart itself is turning, whilst confirmation from the Indicator indicating that there is a Divergence we can trust.

Here's an example for the opposite side with all the steps laid out:

Conclusion:

By no means is this the end of it all. This is a simple technique you can try out the next time you are trading. There's obviously a lot more that goes into this.

To truly use this technique to its full potential I'd advice focusing on mastering what's taught in the Mastering Price Action 2.0 Program, and then you can experiment with the Divergence technique after that.

For now, just remember, Divergence is a very powerful tool, but only used in the right way with good price action knowledge as foundation.

Also remember there is a big difference between Divergent and Divergence...

With pip love,

Lucas at Urban Forex