Is There Any Indicator That Is Useful For My Trading?

Oct 25, 2021

Indicators, what can I say. Probably anyone who's reading this have tried using some sort of indicator before, or for the most part, using indicators in their trading.

In recent years, there's been a lot of debate over how important having an indicator on the chart is. Some swear by them, others may think that they are mumbo jumbo, and some even look down upon them.

Today, I want to bring you guys on a typical journey of a trader who begins their trading career in the early stages with indicators and how things would evolve for them.

Let's call him Joey.

(Yes, let's create some memes with Joey Tribbiani)

In this blog we are going to go over:

1. Indicators Are the Past

2. Several Indicators At the Same Time

3. Transitioning to Price Action

4. Human Psychology in the Markets

5. Do the Pros use Indicator

1. Indicators Are the Past

By definition, indicator means:

'A gauge or meter of a specified kind.'

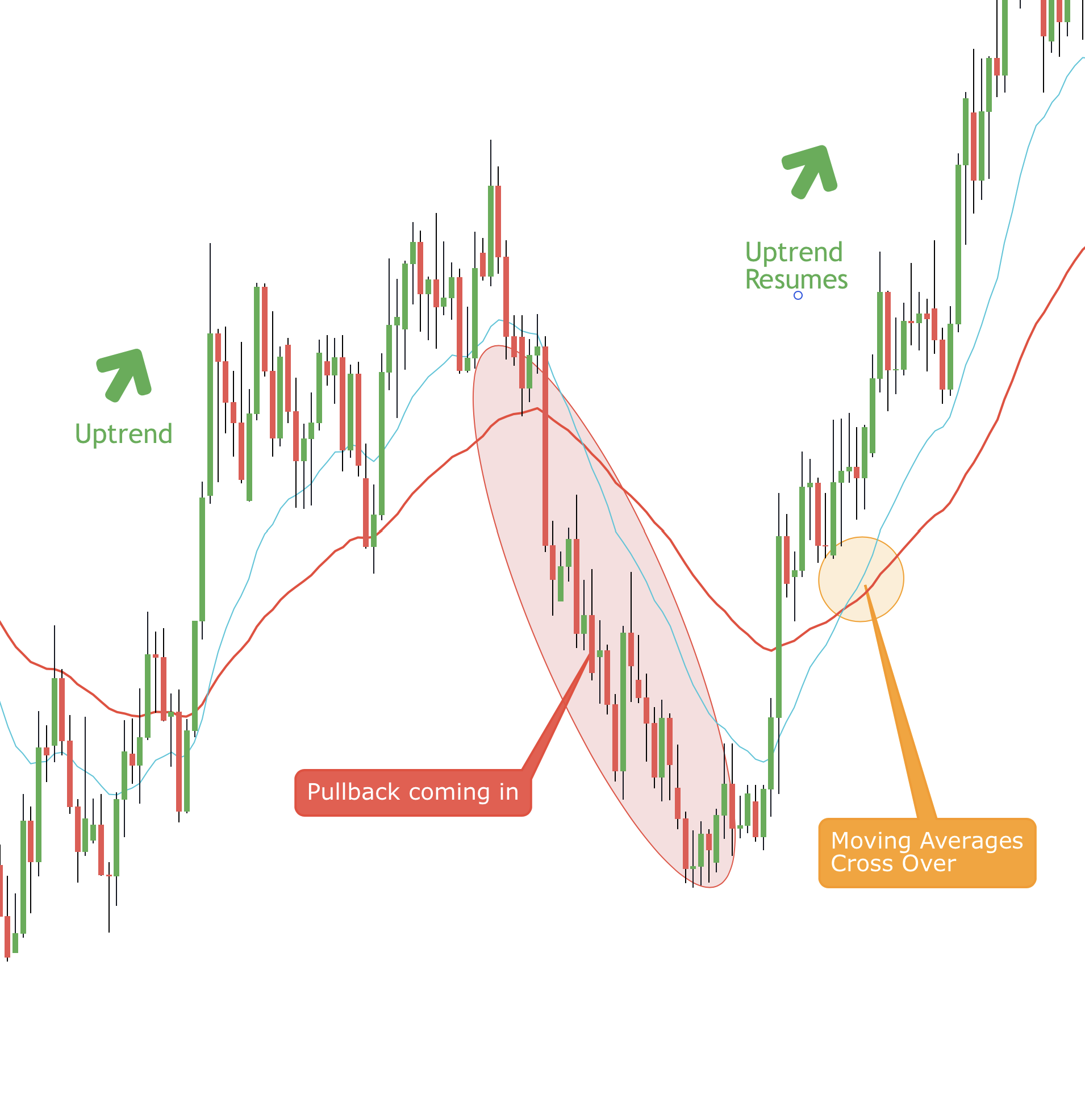

To dig deeper into this, let's go over a very simple indicator and how they are used, say the MAs (Moving Averages) Crossover Strategy. The Idea is, if the lower MAs crossover with the higher MAs, it means the direction has shifted.

Purely using the MAs, you'd know the buy is on now.

Now stay with me here a little, let's try out any indicator.

Let's go with the classic RSI overbought/oversold strategy. The idea for this is, if the indicator is showing price being oversold, we may soon have the opportunity to see a buy coming in.

Buys happen when the indicator says it's oversold.

Easy money right?

Not exactly, here's the thing:

When the MAs have crossed over, on the charts price probably has moved a far distance. If Joey were to join the buys, he would be buying pretty high up.

Now, with the RSI Strategy, although it can work from time to time, it is not always reliable. Sometimes when the RSI is oversold, it will stay oversold for a while and the pullback will come in deeper. This could cause Joey to enter too early and get stopped out. Only to see price go up later on.

Poor Joey, just can't seem to get the timing right with these indicators.

The point here is, indicators can show you a signal, but the timing might not always be right. Either you are in too early or too late.

Very much like the situation when your neighbor tells you about how good a stock is, when you look up on the charts, the price is already at an all time high.

'Well, no sh*t!'

2. Several Indicators At the Same Time

Being a classic Joey,

'If 1 indicator is not 'fast' enough, let's put on more indicators to look for an earlier entry'

Yes, Joey will get the precise entry sometimes, but for the most part, he will be confusing himself with too many indicators.

If he keeps this going, he will age in a few weeks.

Don't be embarrassed if you did this before, because I've done that as well. It came to a point where I couldn't even see my charts.

So, if indicators are not the answer, let's remove them and get to the next hot thing: Price Action.

3. Transitioning to Price Action

Hottest topic that has been going on. Anyone who says they are trading with Price Action sounds more like a Pro now.

(And yes, even our programs have the word price action in it LOL)

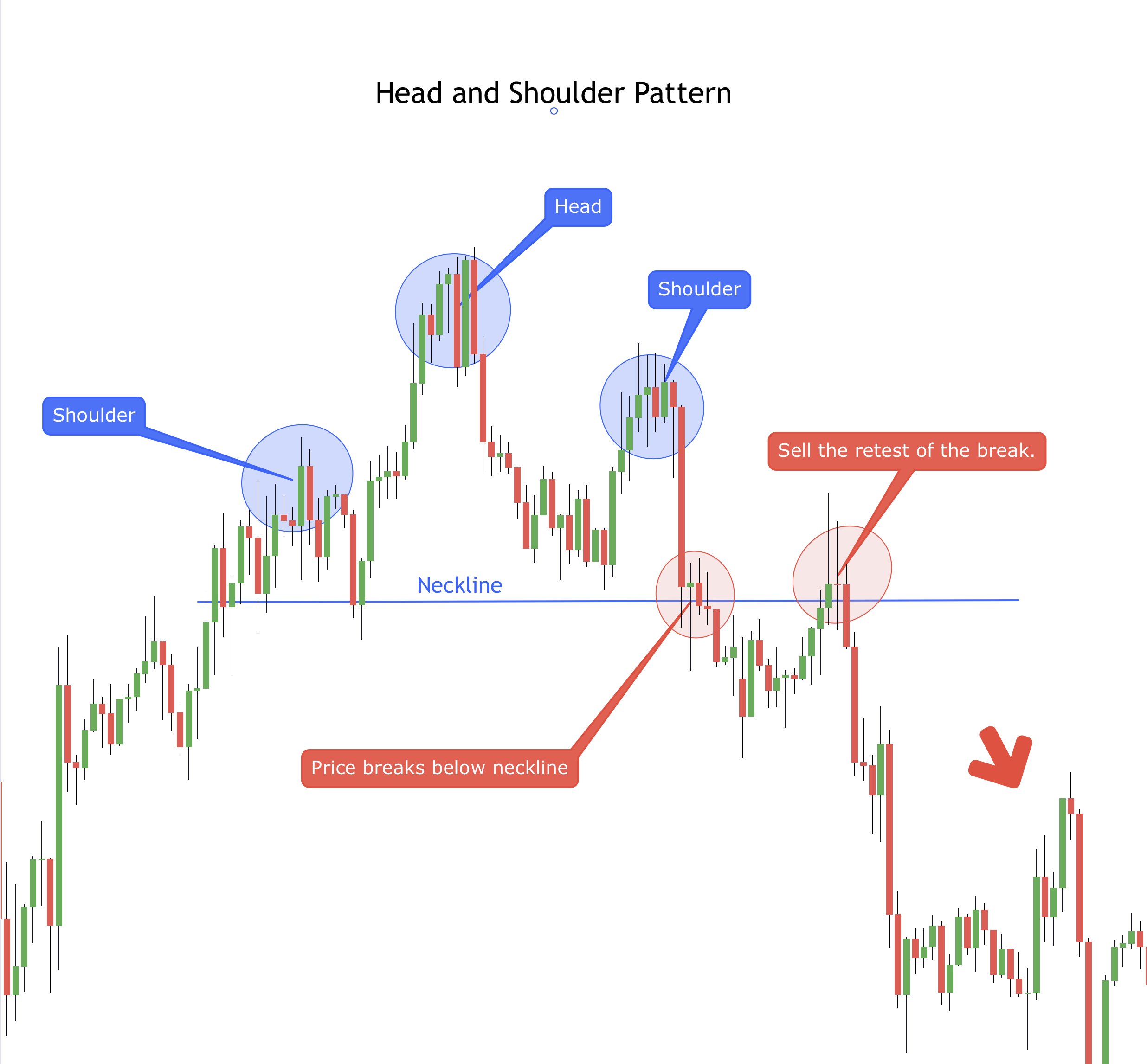

Now, Joey has removed all the indicators and went embarking on this new journey of price action. Namely, price patterns.

First Price Action Pattern he sees:

And Joey is buying drinks tonight!

The next day, same pattern occurs in the market. And he does the exact same thing.

And this happens:

...........

It's all a hit and miss. There's no real edge here. Because guess what?

Price Action Patterns are also an indicator itself. But instead of using an actual indicator, Joey is merely looking at price patterns.

The price pattern becomes the indicator.

4. Human Psychology in the Markets

If Joey doesn't give up and keep looking and researching, this is the next stop in his journey. I'm inclined to say this might be the destination he wants to get to as well.

From the previous few examples, they all have 1 problem, the timing is wrong. A lot of the time, it's almost like most of the move has already happened and he is only getting in with the rest of the world.

The whole goal of trading in our opinion at Urban Forex is:

'Anticipate, don't participate'

The best way to do this is to understand how human psychology works.

To give you a very simplistic example of human psychology, let's go back to the previous example Joey was trading.

Remember when he sold here?

If you are able to understand human psychology, you'd know these are the areas where most traders are looking to sell.

So when that sell fails, and resolves up as a probe, you'd know Joey is giving up on his sell. Once smart players step in here anticipating that it's just a probe, price will push up really far.

In essence, we are trying to anticipate where Joey gets wrong footed, and when that happens, we take the other side. And we know way before the buys become obvious.

5. Do The Pros Use Indicators?

Of course they do! Navin uses them, and most of the guys in Urban Forex Prop firm use them as well. In fact we rely heavily on one particular one:

Volume

But we don't use it like how classical indicators are used. Instead we use it as a reference. In fact, we have MAs as well on our chart.

This is generally how our chart would look like:

The main difference here is not what the indicator does, it is what we do with the indicator.

They act as references, and we (in the Prop Trading Firm) incorporate them with human psychology to look for an edge in the market.

The problem only comes if you solely rely on indicators without understanding the 'Why' behind what's going on in the markets. The same goes for Price Action Patterns.

Conclusion

There is obviously a lot of stuff I cannot review, otherwise students who have actually paid for the

programs will come knocking on my door preparing to kill me.

But like any other blogs, I'm here to debunk what's the hot thing going on on the internet (trading related) in the most unbiased way.

So let me leave you with this question:

'Do indicators work? If not, why do they still receive so much attention?

With Pip Love,

Lucas at Urban Forex