How To Start Trading (Things You Need To Know)

I really had to go down the memory lane for this. Like most of you who are reading, the monetary reward from trading, drew me in rather quickly.

Especially knowing the fact that 90% of traders fail, my ego was like:

'Surely I can be better than these people, if I put in the work. I'm going to be the 10% who will make it. Just imagine what that will feel like.'

This statement is interesting, because of 2 reasons:

1. I'm pretty sure 8/10 traders think this way when they first started.

2. And most of those are wrong to assume that statement.

In any case, there are a lot of reasons why one would want to start trading. And in this blog, I want to go over how most people start their journey and what actually the best way to do it is, in my opinion.

An alternative title to this could be,

'What I wish I knew when I started'

In this blog we are going to go over:

1. On The Back Foot Before Beginning

2. Acknowledging Trading Is A Skill

3. Being A Detective In The Markets

4. Importance Of Post Analysis

5. Conclusion

1. On The Back Foot Before Beginning

In this section, I just want to go over the nonsense (or to put it more bluntly, bullsh*t) we tell ourselves in the beginning stages of our career and hopefully readers who just started trading can avoid these things.

Unrealistic Goals in an Unrealistic Time Span

In a way, this is pretty much unavoidable. It's perfectly normal to begin with a goal in mind. But the goal us traders usually have in mind, is way too unrealistic. Especially with the time span we give ourselves in the beginning.

'I want to make $25,000 a month consistently and quite my job in 6 months'

- 2015, Raju (Who is still in full time employment today)

Don't give yourself unrealistic goals. Doctors have go to school for 7 years and probably another 7 years of residency/fellowship before being able to dream about those numbers.

Do you think one can become a million dollar trader in a year?

Unrealistic Returns

Your Instagram trader has probably tried to convince you that they can double an account size in 2 weeks of trading. You just need to sign up for their $50 course/signal service.

Of course, it's easy right now for me to tell what's realistic and what's not. But in the beginning, this could be quite convincing, (especially with the Ferrari they are promoting their course with.)

Just think of it this way, if someone is able to do that, you probably won't hear about it, because they will be too busy turning $100 into $1,000,000.

Here's a rough ball park number for you to consider, successful funds generally generate 15% annually, whereas 25% would be a fantastic year. I know that's only for funds, traders could make a little more than that, but definitely not to the extend of doubling an account in 2 weeks. Anyone who claims they have done this: Ask them to do it again, and again, and again. They won't be able to do it.

Unrealistic Strategy

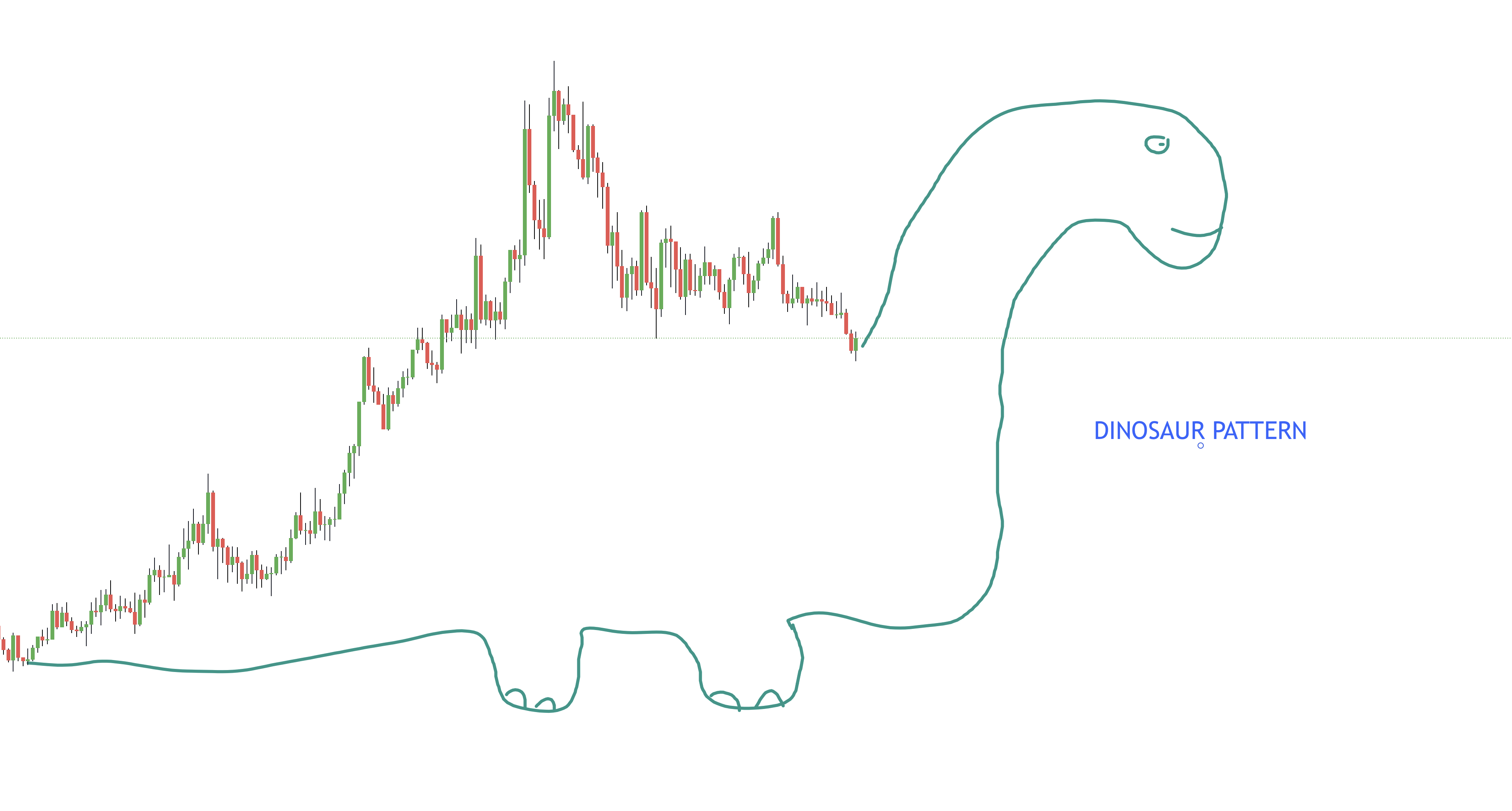

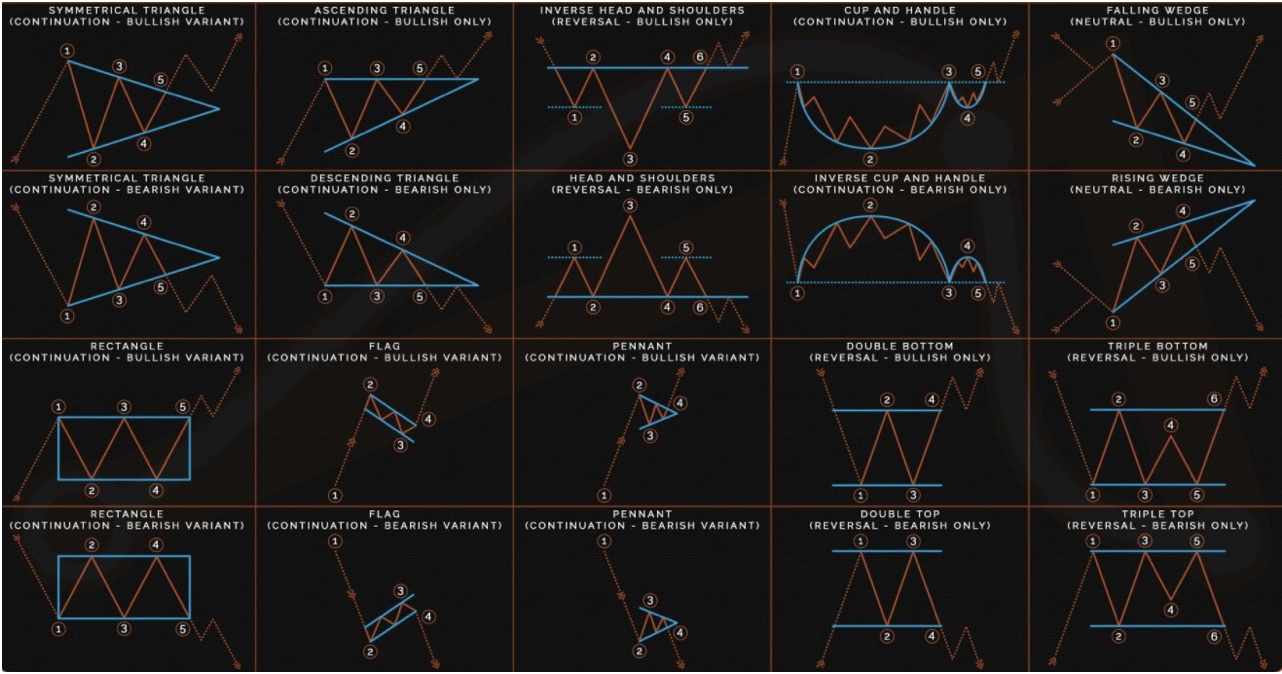

Have you seen this?

If you can convince me that this works, I swear my 8 year old nephew would be a fantastic trader.

Okay fine, I'm actually referring to the classical trading pattern. Here's what they usually look like:

Some traders would be so convinced about these patterns and all they do in the market is look for the Cup and Handle to start trading.

This is stepping into some grey area, because I have seen traders who trade only with patterns and make money consistently. However, I come from a school (Urban Forex) that looks beyond patterns like this.

Again, you want to be realistic and be a little of a contrarian sometimes, if everyone is looking at patterns like this, why isn't everyone making money from trading?

So the answer is not patterns.

I'm sure there are a whole lot more unrealistic things we can go on about, but more importantly, I want to go over what the true focus needs to be.

If there's something you are doubting, just ask yourself if that's something realistic or not.

You should have a clear gut feel of it! (Unless you are one of those Flat Earth believers)

2. Acknowledging Trading Is A Skill

This is a very important concept to grasp for trading. It could feel daunting and empowering at the same time.

Here's why it's daunting:

There's still a decent probability you won't make it as a trader despite having read 50+ trading books and memorised the educational aspects of the course you have.

Put it this way, just because you have learnt all the recipes and done all the research on how to grill a steak perfectly, doesn't mean you actually know how to be a great chef.

Here's why it's empowering,

You cannot expect to learn how to get into a boxing match, if all you do is learn about how to throw a proper hook. You need to practice sparring and getting into matches to truly learn.

Like in the steak example, you'll only know how to properly grill a steak after doing it many times.

In trading, the theoretical and practical part is heaven and earth apart. You really have to put in the time to gain the experience and to grow.

It's empowering because you do not need to be a genius to know how to trade. All you need to know is that you need practice on live charts, to hone the skills. And also because it's a skill, anyone can do it. (with the right mindset)

3. Being A Detective In The Markets

This is the part what traders of all levels should pay attention to.

'Understanding the WHY'

On a certain degree, you can argue that the market 'can do whatever it wants to do'. But if you are a price action trader like me, many times, the market tends to give you clues. Lots of them.

Learning how to pick up clues and cues from the market before, during and after your trade is extremely important. Traders of all levels are guilty of shrugging off a winning/losing trade too quickly.

Instead, (especially for newer traders), you really want to put on your monocle when studying a trade setup (pre, during and after).

If you do not know why you are taking a certain action in a trade, you are better off betting on a Black Jack table.

4. Importance Of Post Analysis

This ties in really well with the previous section.

If I had known this in the beginning part of my trading journey, it would have shortened my learning curve so much more.

Post Analysis is a process done after the trade is completed.

The purpose of this is for you to take a deep dive into what you have done before, during and after the trade. Also, it is important to know what things you are looking to improve on.

Here's how you can do it:

1. Go over what you have done on the trade.

2. Assess if your entry and exits could have been better.

3. Assess if you were actually trading a strategy/edge you planned for.

4. Asses what was done incorrectly and how you want to do less of it.

5. Asses what was done right and how you want to do more of it.

This list can go as long as you want.

Your job here is to extract all the information you can from 1 trade and learn from them.

One post analysis done to perfection would give you as much experience as doing 10 mindless trades.

Conclusion

If you want to be a trader, the first thing to make sure is you have a realistic goal.

As for what comes after, again here are the main things I wish I knew when I first got started:

1. Acknowledging Trading is a Skill

2. Being a Detective and Understanding the WHY

3. Post Analysis

And of course, all of this has to be done with the right education.

For me the Mastering Price Action 2.0 course was the best way to go for this, but I'll leave the choice to you.

With Pip Love,

Lucas at Urban Forex