Understanding Market Direction

Now, I'm sure the title of this blog sounds extremely simple, but I assure you, there's a lot more to it...

Well, thinking about it now, I'd say I may be wrong, it could be extremely simple...

We all know what buyers and sellers mean. But often, we act like we don't when we are investing/trading in the markets.

If you have ever encountered taking a buy trade which comes to the exact price you are looking to get in on and then turns and drops 300 pips (vice versa for a sell trade), you'd probably guess where I'm going with this.

So let's dive into this topic of Buyers and Sellers.

And at the end of this blog, you be the judge of telling me if it's simple or not. And if we are acting accordingly to what we know.

Here's What We Will Be Going Over

1. What do the buy and sell candles mean?

2. Market logic using real world examples

3. How do most typical retail traders fit in that Logic?

4. Buy from sellers and sell to buyers

5. Chart breakdown

1. What Do The Buy And Sell Candles Mean?

We all see the red and green bars (for some it's red and blue) on the charts, but have you actually thought about what they mean to you?

In the most simplistic format, try thinking of it this way:

They are receipts.

Receipts that are printed on the charts FROM the Big Boy's (bigger player's) transactions. So a red bar would mean, the Big Boys were selling and a green bar would mean the Big Boys are buying.

But here's the catch. Just because you see the Big Boys are taking a certain direction, that doesn't mean you have to jump onto the same direction as well. Because you won't know exactly what they are going to do next. Ie, just because they bought a private jet last Sunday, doesn't mean they are going to buy another private Jet this weekend.

2. Market Logic With Real World Examples

I want to give you an example that you'll find fairly logical and easy to understand OUTSIDE of the charts, in the real world.

Consider a Housing Market. Real Estate Developers are planning on a huge project, building houses, malls, shops, etc, say in Dubai.

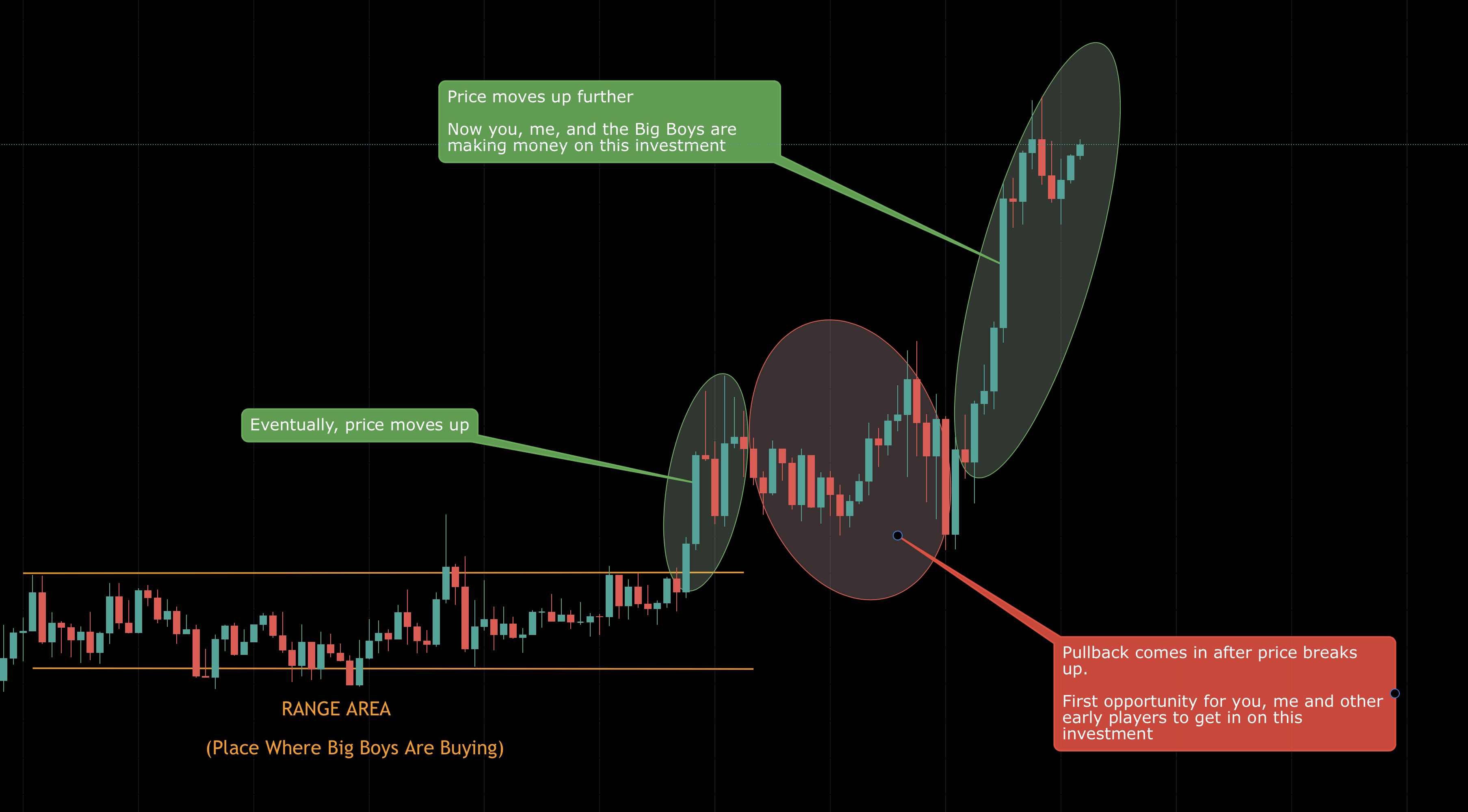

Now, the first person to hear about this would be the Big Boys (the bigger players/investors), hence they begin to invest in this development.

As the development comes to completion, it's catching more attention of the public, ie, you and me. Seeing that this as a potential investment opportunity, we start pilling in.

Now, both you, me and the earlier big boys are making money on this investment.

The project is on the news now. Due to FOMO, Tom, Dick and Harry also want a piece of this investment before they miss the entire move. If they don't get in now, how are they going to get their Ferraris and Lamborghinis?!

Guess what?

The units/shops that you, me, Tom, Dick and Harry bought, were sold to us by the Big Boys...

They have already made a huge chuck of profits, and most importantly, we were the one that gave it to them when we bought at a higher price after them.

And so, like all things, when a market is overvalued like this, it's going to pullback.

Once Tom, Dick and Harry begin to let go of their investments as they see it's devaluing, the big boys will begin buying at a lower price again.

And the cycle continues...

3. How Do Most Typical Retail Traders Fit In That Logic.

So with what being said above, I'm sure you are now familiar with this cycle in the actual markets you are trading in.

Not sure about you but at some point in most trading careers, traders tend to act like Tom, Dick and Harry when they are trading. This probably happened to you as well right?

Phase 1:

Phase 2:

Phase 3:

Phase 4:

Here's the common mistake that a lot of traders do, they are getting in way too late. Yes, I know it's comforting to wait for 'confirmation', but it's actually a double edged sword.

It's essential to find the balance between getting in too prematurely versus waiting for too many 'confirmation'. Otherwise, you will always be the trader who is buying right at the top of the trend or selling right at the bottom of a trend.

If I can give you 1 advice, it'll be..

Don't ever be late..

(something I heard a lot from my teachers in my schooling days too)

4. Buy From Sellers. Sell To Buyers.

I'm pretty sure by now most of us are pretty clear that we do not want to be the Tom, Dick and Harry anymore.

What's the trick to it then? The simple answer of 'Try not being late' is just not good enough.

Through the example I've shown you above, what can you say about the Big Boy's strategy?

Not only did they focus on being EARLY. They are focused on Buying from the Sellers, and Selling to the Buyers.

See the difference? Previous, Tom, Dick and Harry were buying with all the buyers in the market, and they had to pay for it massively when the position collapsed.

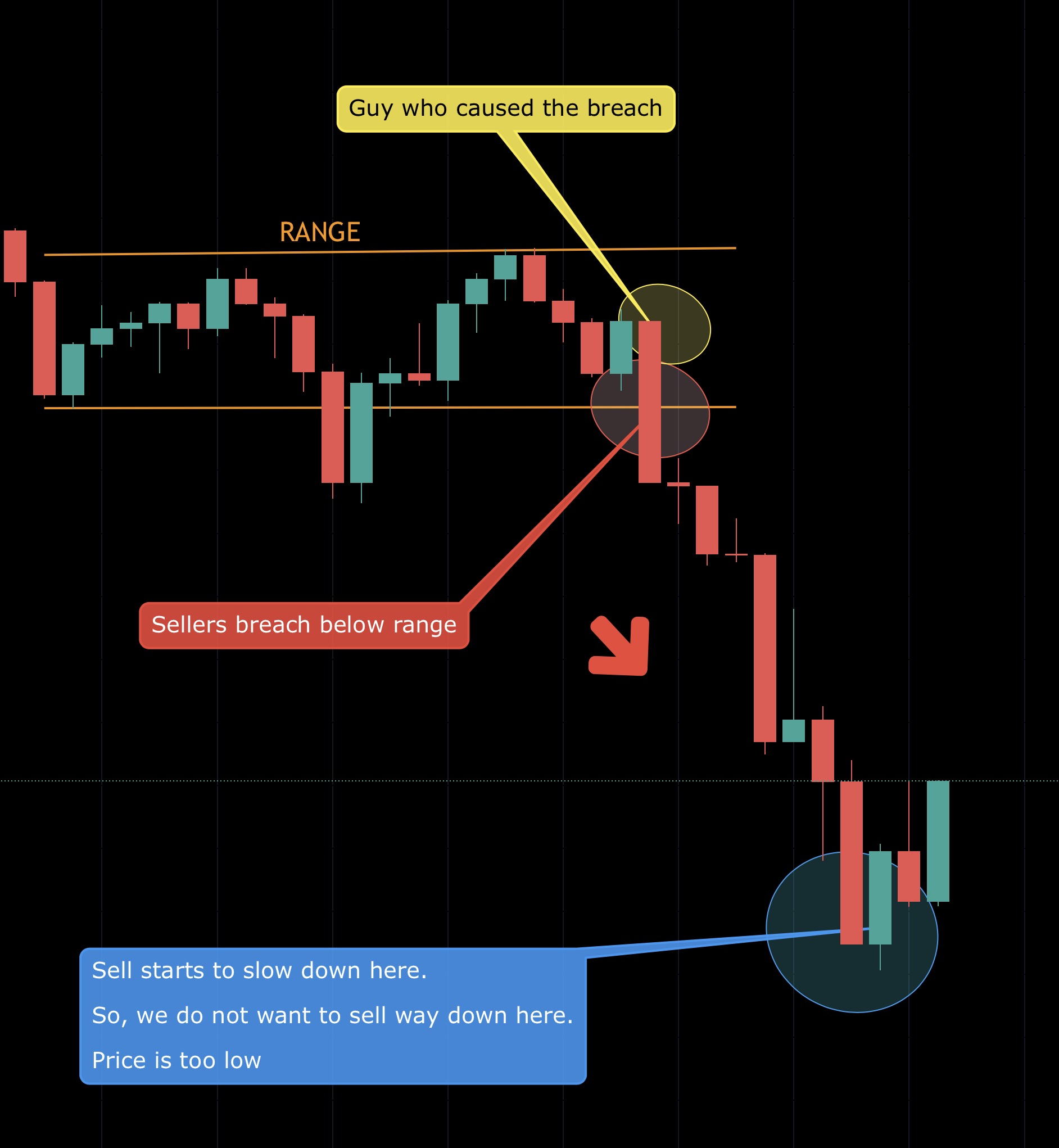

So like the bigger players, our focus is to understand where the sellers are coming in, and buy from them.

The opposite is true too, knowing where the buyers are coming in, sell to them.

5. Chart Breakdown.

Now that you have a rough idea of what's the right and wrong way to do things, I'll give you a few steps that you will want to follow going forward to make sure you are trading on the right side of the markets.

1. Where did we break?

This typically is what people consider as Support & Resistance. But the purpose of this is to understand and make sure we actually clearly made a new high/low.

2. From where did the launch start?

You want to mark out this spot to make sure you remind yourself that the area you marked is still in control of the direction.  So, as you can see, so long as we are below this area, all we want to focus on is selling.

So, as you can see, so long as we are below this area, all we want to focus on is selling.

BUT, at the right price.

3. How far did it go?

You then want to consider how strong that push is and where it starts to stall.

As we went over above, that's NOT the area you want to get into the trade. (this is where Tom, Dick and Harry got in during previous examples, very late)

Wait for price to come back up, because it's currently too low. And the Big Boys may be cashing out a little bit.

4. Money Spot.

(This is actually a well known term we use in the Urban Forex world.)

Notice when price is starts to come up again, this is where Tom Dick and Harry begin to get rid of their position if they got in right at the bottom.

As it comes in higher and more people begin to think that the sells are not working now, that's where you want to begin thinking like the bigger players...

Get ready to sell again.

Now, I hope you'd appreciate that I'm not going to go over the entire process of reading the pullback and exact entries.. Because if I do that, this would become a 10 page article instead.

Check out the Mastering Price Action 2.0 Program here, we go over everything you need to know about getting in good trades and not be like Tom, Dick and Harry.

Conclusion

Hopefully I didn't make this topic way too complicated. These are actually concepts that most of us know. We just need reminders of doing them correctly and not acting irrationally.

Of course, I'm only able to give you a rough guide of how you want to trade like the bigger players here. If you want a more constructive way of learning the technique of this, I recommend picking up the Mastering Price Action 2.0 Program.

So, now back to our initial discussion.

Is the concept of Buyers & Sellers actually difficult? Or easy?

With Pip Love,

Lucas at Urban Forex