How the Forex Market Operates

This blog was a very interesting blog for me to write about (not saying that the others weren't), because it made me stop looking at the trade I'm currently in and got me thinking about this one question:

'Where do we fit into the market?'

Every day, you and I are busy trading the markets, but we rarely stop to wonder, what role are we actually portraying in the markets.

The reason why this is so important is because, by knowing where we fit in, we have higher odds of being on the right side of the markets. And thus, increasing our probability of winning.

Let's dive deeper into this topic.

Here's What You Will Take Away

1. How The World Reverses In The Market vs Real Life

2. What Bigger Players Are Doing

3. Putting It Together And The Money Spot

4. Summary

1. How The World Reverses In The Market vs Real Life

Just the other day, I went out to get myself a new pair of headphones. The guy at the store told me the headphone cost $199.

I told him, 'Nope, can I actually get it at $299?'

If you are wondering, there is absolutely no typo above. But just pause and think about it for a second...

In the markets, I have seen tons of traders, chasing after a market as it's trending higher. (vice versa for down trends)

Say price is at $1.15...

It goes to $1.45...

It then jumps all the way to $2.05.

Then you'll likely hear and see the infamous saying of 'screw it, I'll get in now incase it goes higher without me' followed by a click of a button to get them into the trade.

If you translate that to real life, it's just basically the story above about me at the store trying to buy a headphone at a higher price than it actually is.

Absurd isn't it?

The reason for that is mainly because of FOMO. The fact that we are seeing price on charts rocketing higher, we often think, we do not want to miss out on any potential profit.

But truth be told, the market is here to stay. If it goes without you, there's always another opportunity someday else or somewhere else.

Your trading account however, is not guaranteed to stay...

2. About The Bigger Players (How Do They Think And Use The Market Psychology)

Now here's a better reason for why you shouldn't be pilling in on an up/down trending market just because you think it's leaving without you.

I'm going to demonstrate that by showing what the big boys actually do.

Let's take EURUSD for an example,

1. In order for the big boys in EUR to make money, they have to ensure that their economy does well, and does better than the US Economy.

2. So the EUR big boys go out shopping for assets across the world.

3. As their assets begin to make money, the entire EUR economy becomes stronger. And in this example, stronger than the US economy.

4. And so, the price you see on the charts, EURUSD, goes higher and higher.

Simple enough right?

So now, in order for them to make money, they have to sell their assets. But no other big boys would be stupid enough to buy assets that are already so high up in the sky. They won't be able to make money if it's already so over valued..

What do you think happens next?

Some of you may have guessed it...

This is where majority of traders would be coming in.

Traders will be buying pretty much at the top of the trend, but not knowing they are actually buying from the bigger boys who are slowly cashing out.

Traders are taking on the risk that no smart big boys are willing to take.

Once the bigger players are done cashing out, guess where the price will be?

And if you follow what I'm saying so far, you don't want to be those traders.

3. Putting It Together And The Money Spot

By understanding what the bigger players are planning in the markets, you'll have a better idea on how to position yourself at the right spot to leverage the bigger players' every move.

So let's take it a step further.

Using the same example above, you'll understand that it's a Big No No to pile onto the buys when it's all the way up in the sky.

And if the circumstances sets up correctly, you'll also understand that the bigger players who brought the market up, may be looking to cash out. Which could lead to a down trend coming up.

By the 'right circumstances', I mean the Money Spot. (Something taught in the Mastering Price Action 2.0 Program)

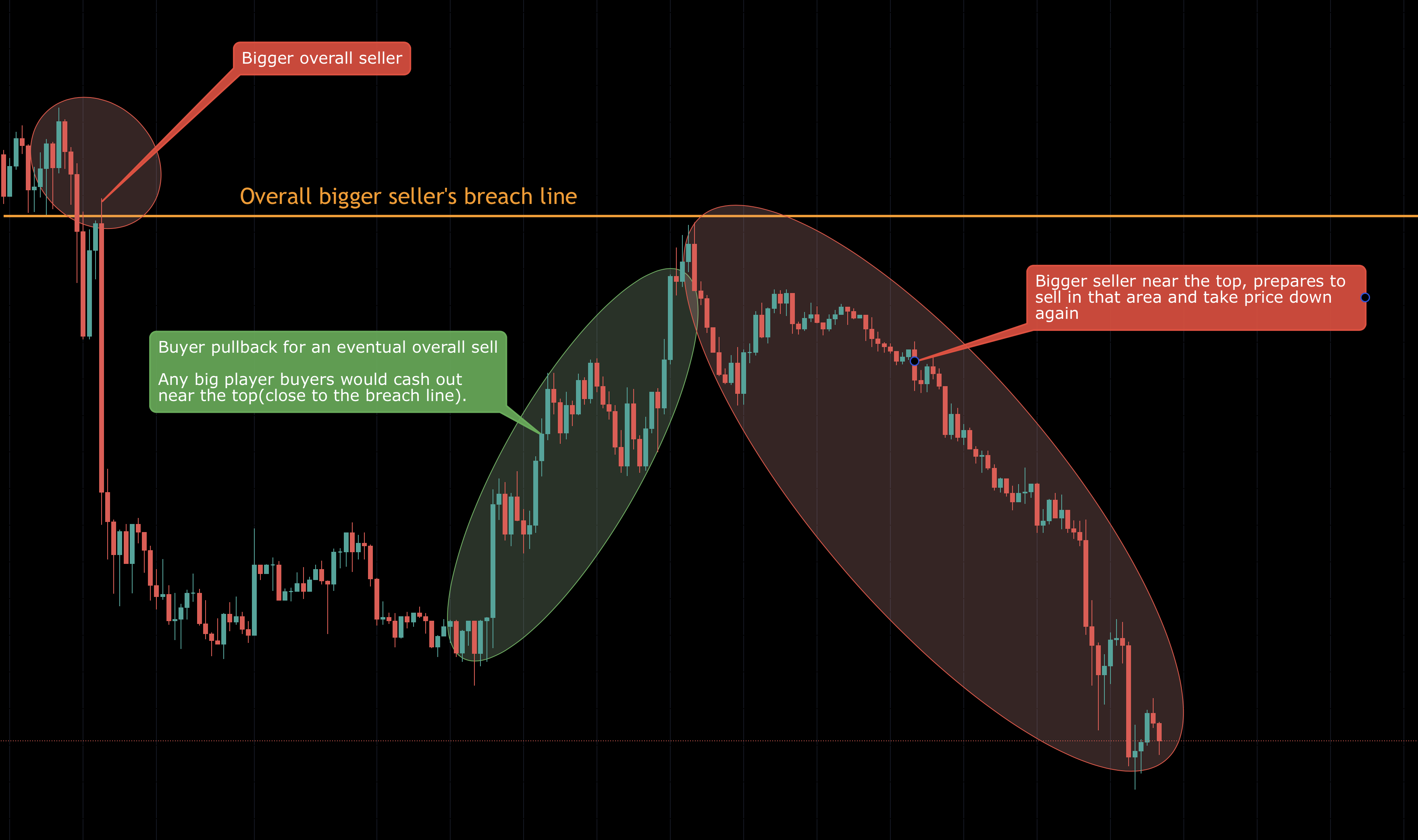

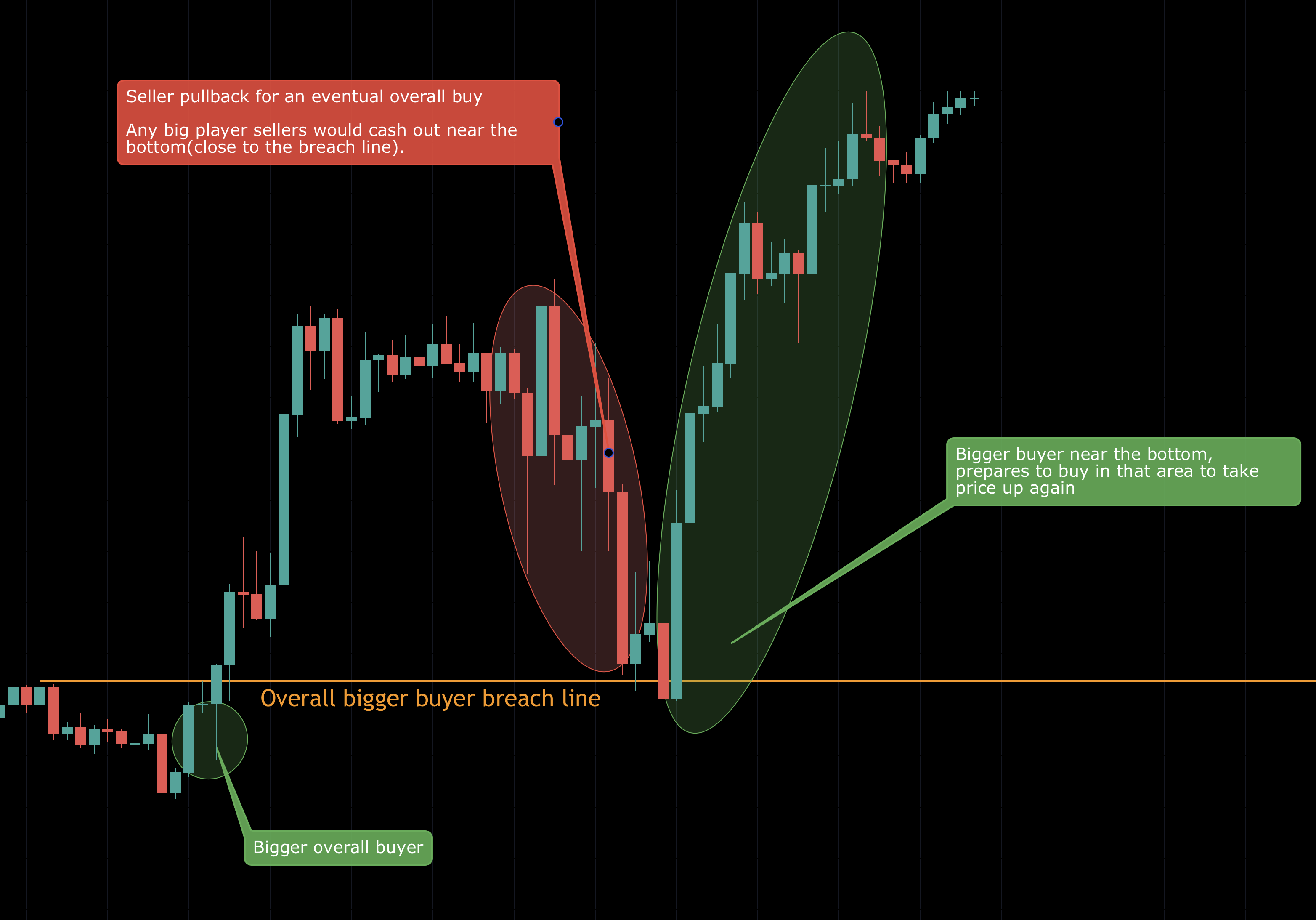

As the uneducated traders are trying to chase the move up, on a higher timeframe, it's actually an area where a much larger player is waiting for price to pullback to sell.

That's a Money Spot.

Here:

This right here, creates an interesting dynamic.

1. The move to the north is slowing cashing out.

2. A much much bigger player is sitting at the top waiting to sell whatever is coming up.

Both of this will cause the uptrend to turn around.

So that area, at the top, is not where you want to think about buying. Is where you want to prepare for a sell.

The opposite is true for preparation to buy.

Conclusion.

Essentially, this turned out to be a long rant about the Importance of a Money Spot and what it actually means in the grand scheme of things.

Whenever you are trading, always think about the bigger players, think about what's logical for them. As you already know that 90% of traders fail in the market, you want to think smarter.

You may not be the bigger player in the market, but you can be the Smarter Player.

Now do you know where you fit into the markets?

With Pip Love,

Lucas at Urban Forex